UVXY Options Trading Strategy

I have been trading UVXY options as of late and managed to find a trading strategy that is quite successful. As a lot of you now, volatility has been at multi-year lows with no bounce in sight. This is no doubt due to various factors but the current market environment has destroyed volatility as we know it. However, one should remember that volatility always comes sooner or later.

Basically, buying put options (either slightly ITM or slightly OTM depending on your risk tolerance) about two weeks out on UVXY has been consistently profitable. I personally think that the latter is the best way to profit from the low volatility. Some might choose to short the security, which is significantly riskier and provides a lower profit potential. Furthermore, one might decide to go long SVXY, which is less risky with and not a horrible idea by any means. But, once a again it would be leaving money on the table compared to options.

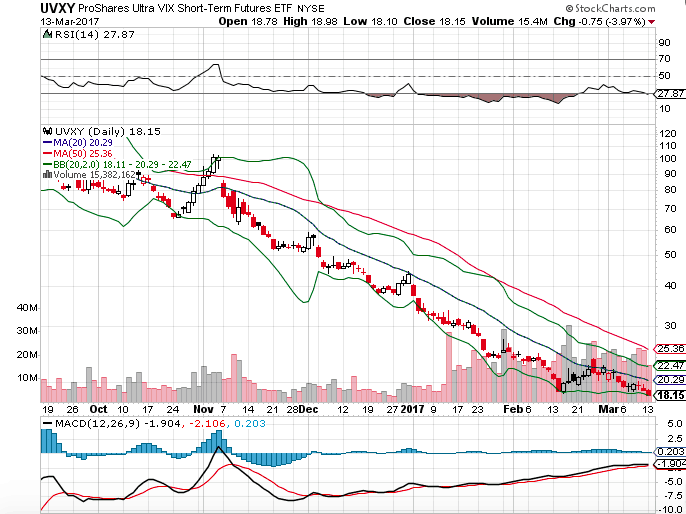

Buying put options on UVXY (instead of all the other VIX-related instruments) is best because of its leverage and time decay. These two things combined practically guarantee that UVXY (PowerShares Exchange-Traded Fund Trust II) will drop over time. This can be seen on the chart below:

UVXY Technical Analysis

The chart shows how the ETF is destined to fall. As you can see, UVXY often drops after approaching or testing the 20 day SMA (best area to enter a position betting against the security). Granted, UVXY has been holding up better recently but it looks ready to drop nicely very soon. Remember, this is an ETF that survives on reverse-splits.

Finally, I would like to thank you for reading my post. If you found this UVXY options trading strategy interesting make sure to follow me on StockTwits and Twitter (@TheRightTrader) to stay up-to-date with my content. Best of luck trading 😉