How profitable is palladium investment compared to gold?

In today’s article we will be taking a look at the huge opportunity that Palladium investment provides. What is surprising with this lesser-known metal is the fact that it has historically huge returns compared to some of the other precious metals out there. In fact, this is the only metal that has performed similarly to bitcoin. Indeed, palladium has seen multi thousand percent gains over the last few decades.

To analyze just how profitable palladium investment can be, we will analyze different charts showing the price versus different assets such as the SNP 500 and gold. It’s also important to remember, that Palladium, is in fact one of the big four precious metals.

Palladium Investment Long term Historical Price Chart

In the palladium price chart below, we can see that Palladium‘s price has grown steadily over time. Surprisingly, its price has been very steady over the decades and has actually seen consistent growth over time. This remarkable rise was due to more use of palladium in various sectors and in jewelry making. It is interesting to think that the effect of companies searching for alternative metals to gold and silver has led to palladium being the top performing precious metals in the last few decades.

In my opinion, this is likely to continue overtime. I see no reason why palladium will stop performing as it has. This of course provides a reasonable and convincing reason to have this precious metal in your portfolio. Of course, as with all of these modern investments, you can either hold the precious metal in physical form or through an investment fund such as an ETF. It is ultimately up to you how you decided to go about your palladium investment.

Moreover, Palladium serves a special purpose in one’s portfolio through the form of diversification compared to other traditional metals such as gold and silver. A little known fact that my interest you, is that palladium in nature tends to be about 30 times rarer than gold.

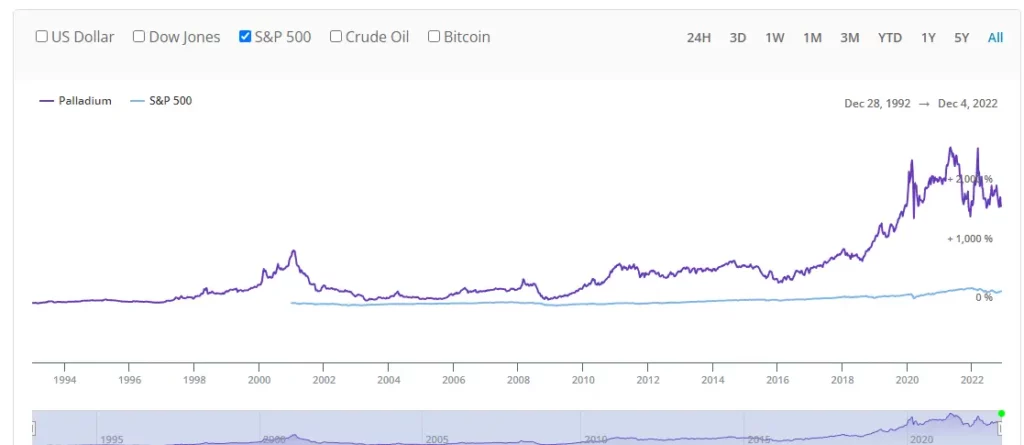

Palladium Investment vs Stocks

Now, we will be looking at the price performance of palladium versus the S&P 500. Here we see how weak the S&P 500 performs compared to palladium. I’m guessing that at this point you’re starting to see just how undervalued palladium is and how overlooked it is by many investors. What’s crazy, is just how much palladium has outperform the S&P 500 which is one of the benchmark investment products in terms of safety.

Obviously, this is not to say that you should not own the S&P 500 or any of the companies in it. It’s important to know that palladium does not have the same price history as gold and silver. The ladder to have been tested overtime and have also seen their price steadily increase. However, it would seem foolish based on this data to not whole palladium in, at the very least, your precious metal portfolio.

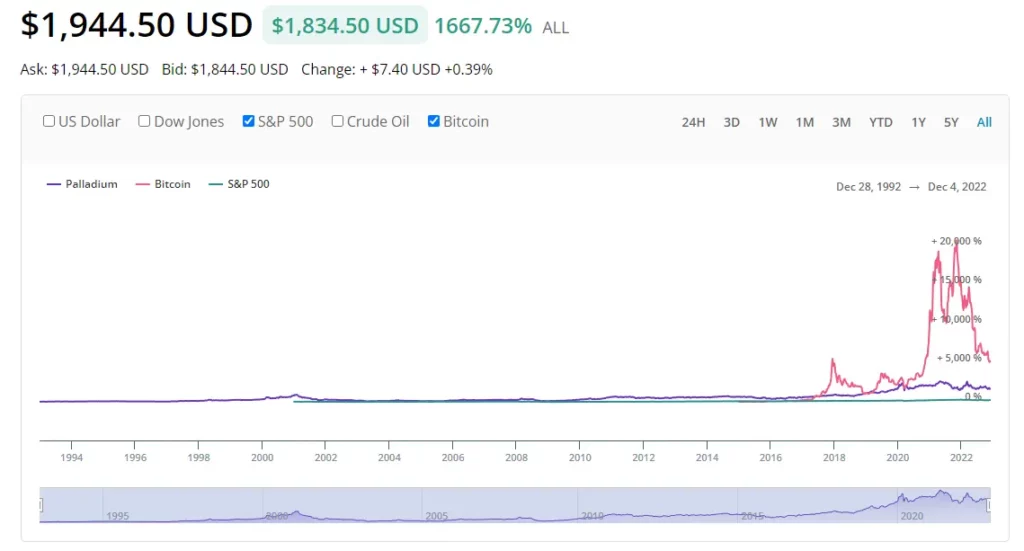

Palladium Investment vs Bitcoin

An even funnier comparison, is palladium versus bitcoin. It’s number one cryptocurrency that everybody knows and which outperform every asset on earth in the last 10 years has in fact not been beaten out by that much by palladium. Although, bitcoin has outperformed palladium by some margin. Palladium has seen multi thousand percent returns over the last few decades combined with very decent price steadiness and stability. Seeing how palladium tends to outperform many assets and other precious metals, This may be a sign it is a must-own.

Palladium ETF or Physical Holding

You might be wondering if you should hold palladium physically or through an ETF. This is a common question when investing in precious metals. If you’re looking for the more traditional method, then the physical form is the way to go. This provides less counterparty risk and you get to hold what you own.

However, if you want less hassle then there are many ETFs out there or other investment products that allow exposure to palladium either directly or indirectly. One of the most popular and best palladium etfs is the abrdn Physical Palladium Shares ETF that goes by the ticker PALL.

Naturally, This then depends on the amount of exposure you want to have. If you want an investment product that provides 100% exposure to palladium then go for an ETF that’s built for that instead of a diversified ETF. Don’t get it twisted, this doesn’t mean Palladium is the only thing you should hold in your portfolio.

Conclusion: Palladium Investment is a good idea

To conclude this article, we want to remind you all the different charts and data we showed you throughout this post. It has, helped you see, just how impressive, Palladium can be for investment. This often ignored precious metal, has outperform the S&P 500 and many other investments, while still being relatively safe. For this reason, I personally think, in my own opinion, is an investment to not only have in your precious metal portfolio but also in your general investment portfolio.

We hope you enjoyed learning more about palladium investment and the opportunities that comes with it. Now, you can ask yourself the question of if you’re going to start stacking palladium or not. Needless to say, the dater may answer that question for you.