Gold ETF Price Increases

Today, the gold etf $NUGT and many others skyrocketed as recession and stock market fears continue to grow. Some people are still skeptical that gold price will rise in coming months. However, history shows us just how “safe” gold can be in this situations, which we’ll take a look at in just a second. On top of its “perceived safety”, the price increases tend to be significant as well! Before we head into more details on the matter, check out my video on the best gold mining stocks below:

Best Gold Mining Stocks:

Gold’s Historical Performance (Gold ETF analysis)

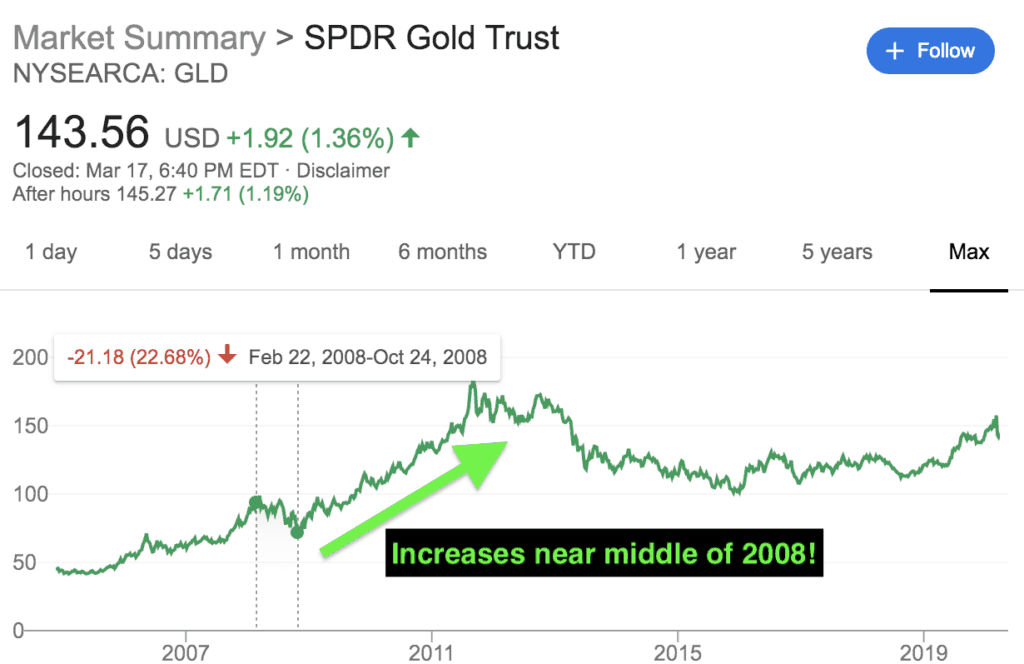

Let’s take a look at how gold has performed in these types of situations. First off, it is know that gold price typically doesn’t increases immediately at the beginning of recessions. This is due to initial panic, which I talked about on my twitter here. The idea is that at first fear and panic causes investors to sell everything including precious metals like gold and silver. With that being said take a look at the SPDR GLD Gold ETF for proof below:

Gold ETF Performance in the 2008 Crash:

Now, you can clearly see that this gold etf, which tracks gold price, fell 22% before increases significantly and entering a strong bulol run. In fact, the increase only began near the middle or even towards the end of 2008 around October. Once the initial panic from the crash clears up, investors are more level headed and flock to gold a “safe haven” for financial protection. I believe this time will be no different!

A quick look at silver:

Silver on the other hand tends to have an even more delayed effect. This is due to it only tending to increase after gold begins increasing. So, don’t expect silver to make gains until gold prices advances forward decently. On the plus side, once it catches up to golds increases it usually outperforms it on a percentage scale of increase. However, this comes with more generalized volatility for silver.

I myself have invested both in physical gold and silver in prepartion for the upcoming recession. Investing in a Gold etf can work great to. There are gold etfs that track gold price such as SPDR GLD, which is a really good one or options that are more risky such as the $NUGT 3x gold etf.

Follow Me On Social Media:

That completes my list of the best stocks to buy during a recession. Don’t forget to Follow Me on Twitter and YouTube. You can also learn technical analysis trading with my course HERE.